Avalanche Liquid Staking Using Core Wallet

What is the point of liquid staking?

Staking AVAX tokens requires you to lockup your tokens for a set amount of time. Validators must lock their tokens up too, usually intervals of 3, 6, 9, or 12 months.

This doesn’t work for everyone. DEGENS often like full liquidity, so they can quickly trade or lend out their tokens to earn extra yield. That’s where liquid staking comes in. Benqi is the OG and most popular AVAX liquid staking protocol.

Avalanche Liquid staking on Benqi allows you to swap your AVAX for sAVAX tokens. sAVAX tokens accrue AVAX rewards simply by sitting on chain. You don’t have to do anything with them.

The Benqi platform also allows you to supply other assets, like USDT, USDC, and WBTC to earn QI tokens. The QI token is Benqi’s native utility and governance token.

QI tokens can also be earned by supplying Benqi with your liquid staked sAVAX. Many people generate additional yield by depositing their AVAX, receiving sAVAX in return, and then supplying their sAVAX back to Benqi. This would allow you to earn AVAX and QI rewards.

Your QI tokens can then be staked to earn more QI. And, staking your QI allows you to vote and boost the AVAX staking yield for your favorite validators.

If you are staking your QI tokens, please vote for Atlas Staking. Our Node ID: MmTfUacXsPdKryR3WkVteMqoFvyxEdYf4

Is liquid staking risky?

Liquid staking does carry extra risk. All derivatives do. You not only have the risks associated with the AVAX token, but you have the extra risk of the liquid staking provider getting hacked, or going insolvent, etc.

So, for the average crypto investor we recommend no more than 25% of your holdings in liquid staking derivatives. DEGENS are usually comfortable with a much higher percentage.

How to liquid stake AVAX using Core wallet

Core wallet is the preferred wallet for the Avalanche ecosystem. In this step-by-step tutorial we will show you how to liquid stake AVAX on Benqi using Core wallet. It’s a piece of cake! Remember, you will need AVAX tokens for gas.

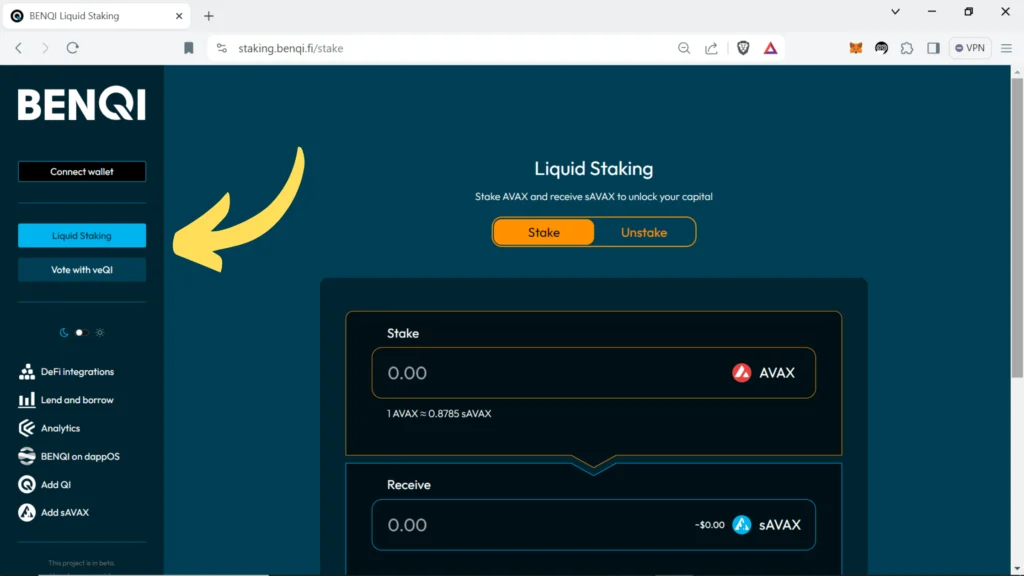

1. Navigate to https://staking.benqi.fi/stake. (see image below)

2. Click “Connect wallet” and select “Core.” (see images below)

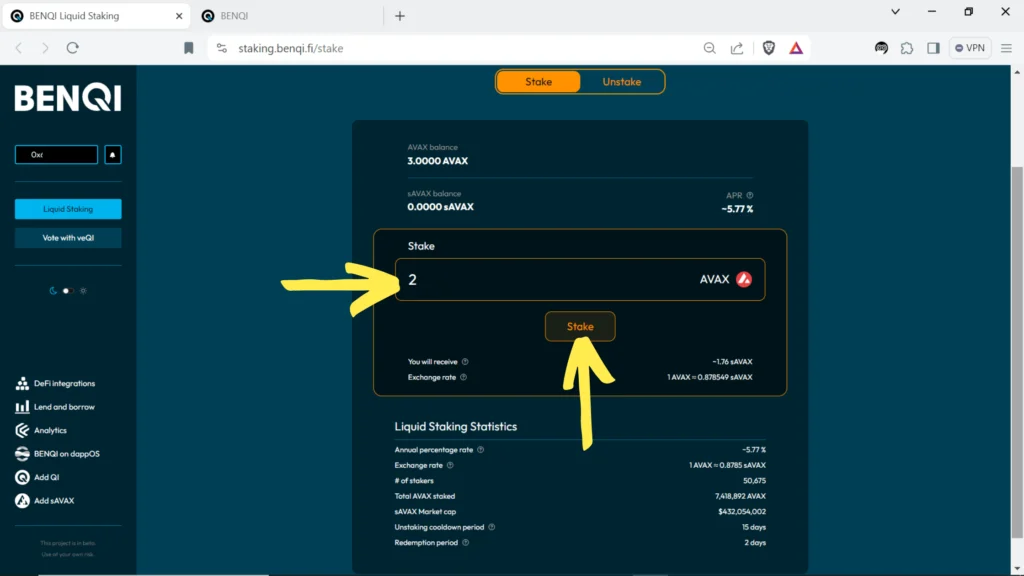

3. Enter the amount of AVAX you would like to liquid stake and then click the “Stake” button. (see image below).

4. Confirm the transaction in your Core wallet. Remember, you need AVAX for gas. (see images below)

5. You will then see the sAVAX position in your wallet. (see image below)

That’s it! You have liquid staked your AVAX tokens and have full liquidity while also earning staking rewards.

However, you can earn extra yield by supplying your sAVAX tokens back to the Benqi platform. The extra yield is paid in Benqi’s native, QI token.

Supply sAVAX to Benqi and earn QI tokens

Benqi needs liquidity so people can liquid stake their AVAX tokens. If you lend your sAVAX back to the platform they will pay you with QI tokens. You can then stake your QI to earn even more QI tokens! It’s a common strategy to earn extra yield.

Staking QI tokens provides you with vote escrowed QI tokens (veQI). The veQI tokens allow you to vote for your favorite validators, which boosts their AVAX staking yield.

Be sure to check out our detailed QI staking tutorial.

To supply your sAVAX tokens to Benqi and earn QI tokens:

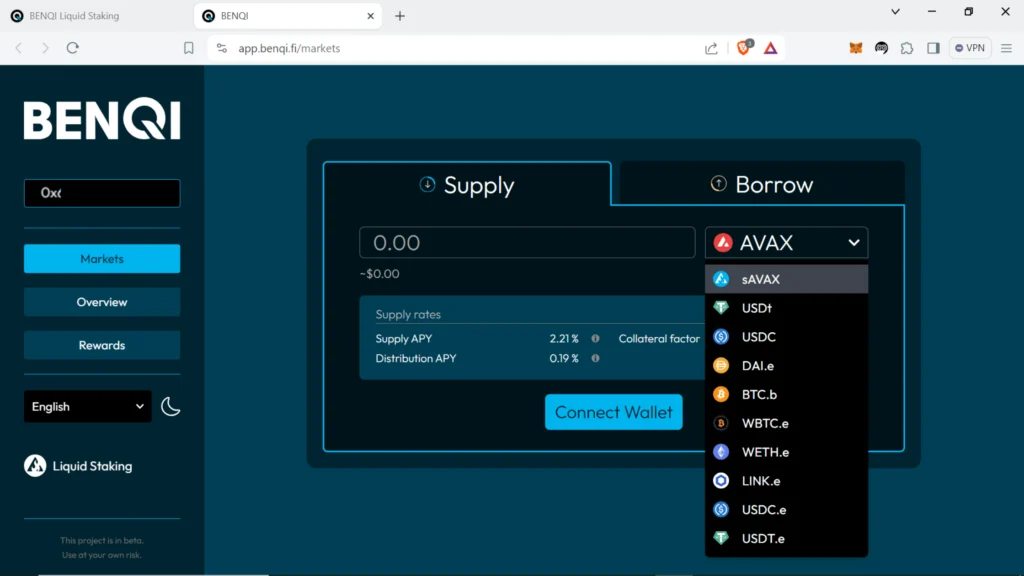

1. Click the “Lend and borrow” tab on https://staking.benqi.fi/stake and it will take you to their markets page. Click “Connect Wallet” and select Core. (see images below) Remember, you will need AVAX tokens for gas.

2. Click the dropdown. You will see all the various assets that you can supply to Benqi to earn QI tokens. Select sAVAX. (see image below)

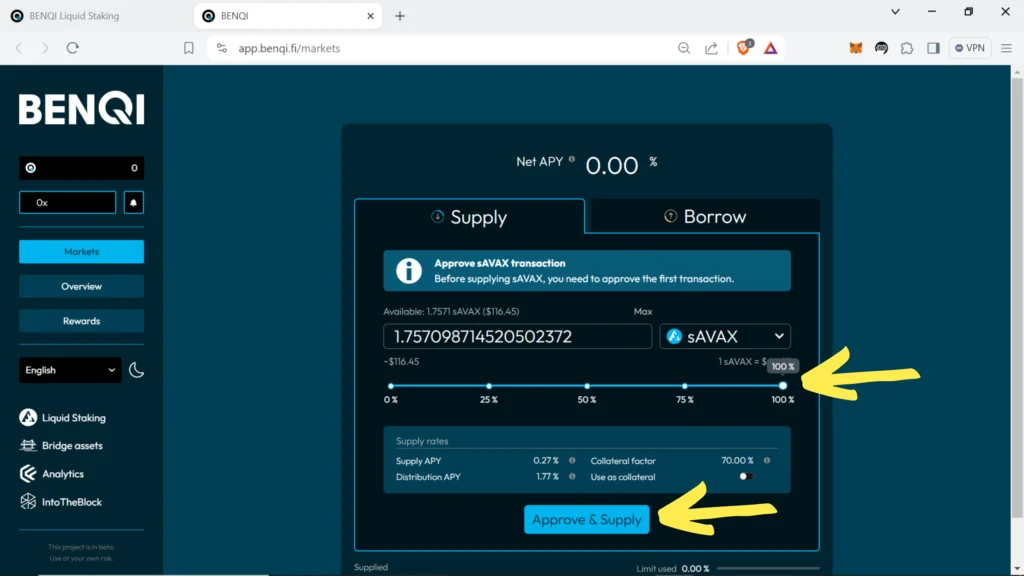

3. Use the slider to choose the percentage of your sAVAX tokens you would like to supply to Benqi. Or, enter the number in the box. Then click “Approve & Supply.” (see image below)

4. Click “Approve” so the sAVAX tokens can be moved from your wallet address by Benqi. (see image below)

5. Click “Approve” to submit the transaction and supply your sAVAX to Benqi. (see image below)

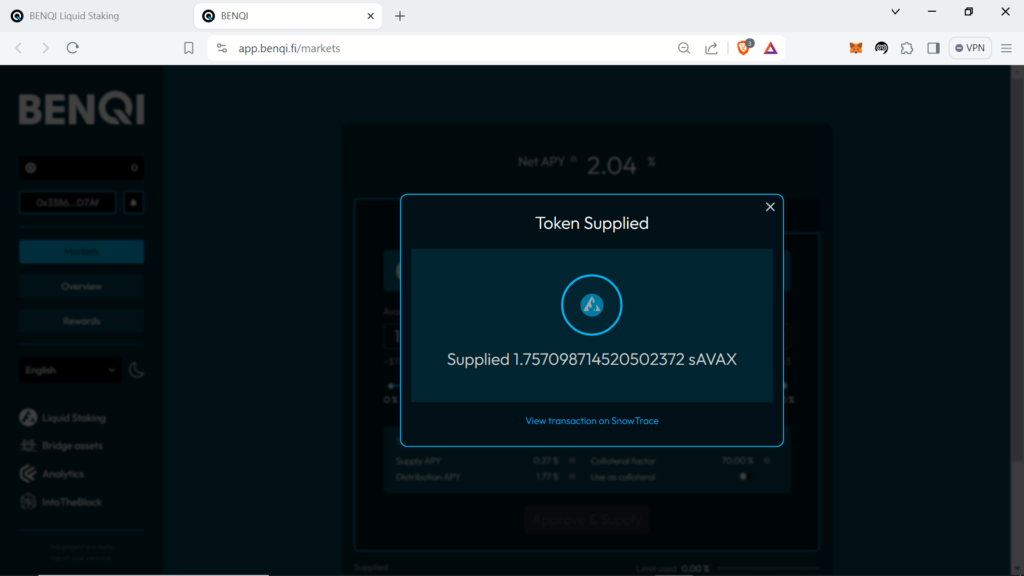

Click the X in the top corner to close out the confirmation message.

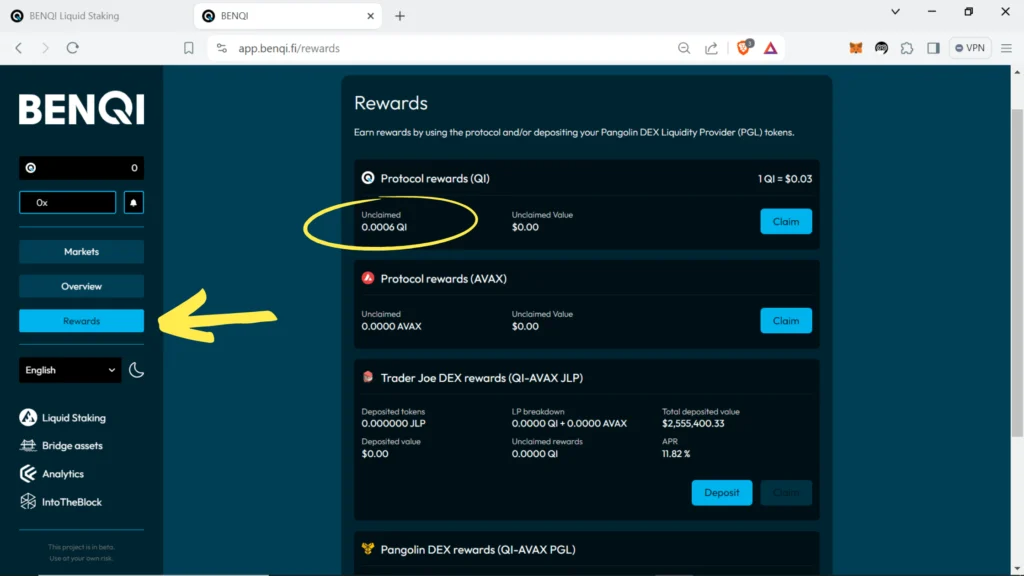

6. Then, click the “Rewards” tab in the menu and you’ll see that you are now earning QI tokens! (see image below)

Now you know how simple it is to supply sAVAX to Benqi and earn QI tokens.

What can I do with my QI tokens?

After you have earned a stack of QI tokens, you can stake them. Staking QI tokens not only pays you more QI tokens, but allows you to boost the AVAX staking yield for your favorite validators.

Be sure to check out our detailed QI staking tutorial.

Frequently Asked Questions

People stake tokens to support the underlying blockchain and earn more tokens for doing so. Staking often requires a lockup period, when you don’t have access to your tokens. Liquid staking providers stake your tokens for you and issue a derivative token as a sort of receipt.

The AVAX derivative liquid staking token from Benqi is sAVAX. The sAVAX earns AVAX staking rewards simply by existing and sitting on-chain. The sAVAX is also fully liquid and able to be swapped for a different token, or lent out to generate additional yield.

Liquid staking allows you to earn staking rewards, while maintaining full liquidity.

Liquid staking does carry additional risks. It is a derivative, a representation of an underlying asset. sAVAX is not AVAX. It is a representation of AVAX. Therefore, as an sAVAX token holder you bear the additional risks associated with the entity that issued the derivative token.

That means if Benqi is hacked, goes insolvent, has governance taken over, etc, the sAVAX token could lose its peg to AVAX as people rush to sell it. Because of these additional risks liquid staking tokens are often more volatile than the underlying token.

We are not tax advisors, so we always recommend consulting a tax professional in your jurisdiction. However, liquid staking tokens are generally only taxable when sold. The staking rewards that accrue are not a realized gain or loss until you sell it, because you would receive more tokens than you initially put in. A loss would occur if the dollar value was lower after selling the liquid staking token when compared to the initial dollar value you paid for the liquid staking token.

Nothing we say is financial advice or a recommendation to buy or sell anything. Cryptocurrency is a highly speculative asset class. Staking crypto tokens carries additional risks, including but not limited to smart-contract exploitation, poor validator performance or slashing, token price volatility, loss or theft, lockup periods, and illiquidity. Past performance is not indicative of future results. Never invest more than you can afford to lose. Additionally, the information contained in our articles, social media posts, emails, and on our website is not intended as, and shall not be understood or construed as financial advice. We are not attorneys, accountants, or financial advisors, nor are we holding ourselves out to be. The information contained in our articles, social media posts, emails, and on our website is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in our articles, social media posts, emails, and the resources on our website are accurate and provide valuable information. Regardless of anything to the contrary, nothing available in our articles, social media posts, website, or emails should be understood as a recommendation to buy or sell anything and make any investment or financial decisions without consulting with a financial professional to address your particular situation. Atlas Staking expressly recommends that you seek advice from a professional. Neither Atlas Staking nor any of its employees or owners shall be held liable or responsible for any errors or omissions in our articles, in our social media posts, in our emails, or on our website, or for any damage or financial losses you may suffer. The decisions you make belong to you and you only, so always Do Your Own Research.